Record Land Values – Is This Setting Up For A 1980’s Repeat?

__primary.png?v=1675352898)

From Winter 2023 Hertz Outlook Newsletter

When asset prices make historic highs, such as current land values, investors in any market can start to wonder when the top will be made and how far it may tumble when it turns. The most dramatic crash in Midwestern farmland values occurred in the mid1980s. Are we setting ourselves up to repeat that fall? Most agricultural economists agree that the current land market is not as vulnerable as it was then, even though interest rates are starting to climb.

Four reasons this is not the 1980s:

1. Farmland is held in very strong hands.

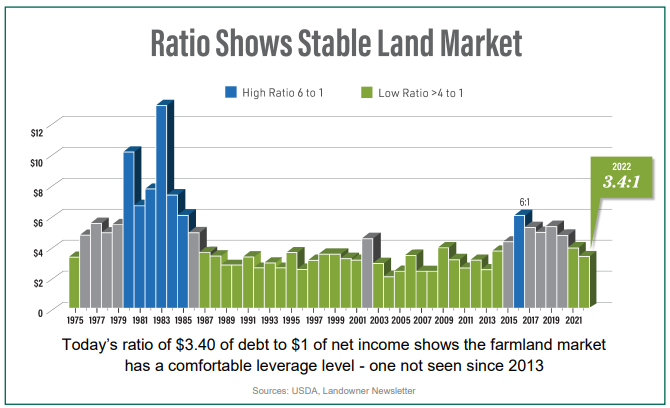

Iowa State reports 82% of farmland is owned debt-free. “And, we have a very healthy marketplace,” says Doug Hensley, president of Hertz Real Estate Services. The debt-to-income ratio on farms, according to USDA, is very healthy at 3.4:1. In the 1980s, it was an unsustainable 6:1, or higher. (See below chart) Current land buyers are paying with cash or a large down payment.

2. Interest rates have risen, but are still historically relatively low, especially compared with the 1980s.

The average mortgage rate in 1981 was 16.65%. And unlike buyers’ dependence on variable rates in the 1980s, “most landowners in the past several years have locked in extremely low, longterm fixed interest rates,” says Hensley. “Borrowers are simply not as exposed as they were 40 years ago.”

3. Lending practices have become more conservative.

In the 1980s, lenders were willing to lend up to 80% of a farm’s market value. “Today if you’re buying land for $15,000 per acre, a lender may only be willing to lend $6,000 to $7,000 per acre,” notes Wendong Zhang, an agricultural economist with Cornell University, and formerly with Iowa State. “Farmers used a lot of debt in the 1980s to buy ground and tied up their fully-paid land as collateral,” explains Zhang. When land values dropped, some lenders foreclosed on even previous low-debt land to get their money back. Farm sales then flooded the market, exacerbating the crash in values.

4. Today’s farm profits are real and continuing.

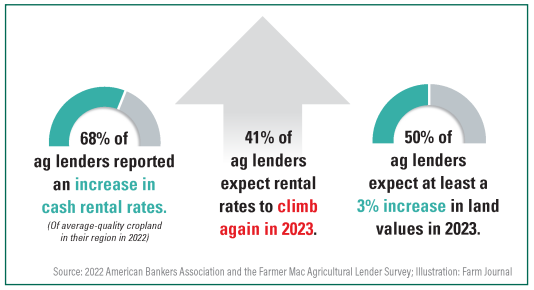

In a recent American Bankers Association and Farmer Mac Ag Lender survey, bankers indicated they expect profitability among their borrowers in the coming year, although profits won’t be as high as in 2022. (See chart below) Another difference between now and the 1980s, says Zhang, “Farm income growth in the 1970s came mainly from inflation.” When inflation was reduced, so was farm income. “Over the past 15-20 years, farmers have seen real income gains,” says Zhang.

This is not to say farmland values cannot go down. Farmland as an asset class, like many asset classes, can be cyclical. However, because of the reasons mentioned above, among others, few industry experts predict a repeat of the 1980’s.