Land Values End 2022 at Record Levels – 2023 May Look Different

__primary.png?v=1675353647)

From Winter 2023 Hertz Outlook Newsletter

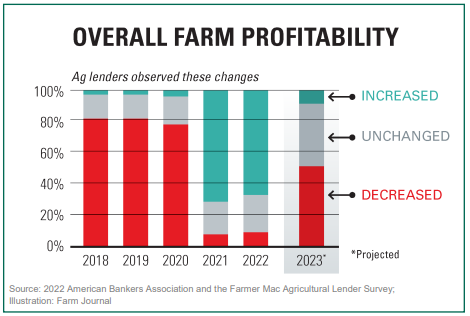

Headline-grabbing land sales, historically strong grain prices, and solid crop yields pushed land values to record prices in many, if not most, areas in 2022. “This past year has been the most profitable year ever for the vast majority of farmers, and that has been reflected in the farmland market,” reports Doug Hensley, president of Hertz Real Estate Services. However, Hensley is cautious about the land market heading into 2023. “No doubt, the farmland market is strong, but I think the 10% to 25% year-over-year increases in Midwest land values is over.” Hensley believes we’ll look back on the years 2021 and 2022 and see they were pretty special in the farmland market.

Hensley believes the market is shifting to become less predictable, not necessarily heading south. “We’ll see choppier price patterns ahead, with results from area to area that may appear uneven.” For example, in mid-December a 76-acre parcel of top-quality land (94.8 CSR2) in Benton County, Iowa sold for $21,300 per acre. A day before that, approximately 100 miles away in Floyd County, a similar 100-acre property (95.7 CSR2), sold for $14,800/acre. Both farms were very high quality properties that can produce 250+ bushel corn. And in spite of the $6,500/acre difference in sale price, both sales were considered strong for their neighborhood. “The main difference was the competitiveness of the local neighborhood,” explains Hensley. “I think we may see more of this play out in the coming months.”

Looking ahead, Hensley sees an offsetting pushpull of land market factors emerging, which will move farmland prices into a sideways pattern in 2023. And we are likely to see quality patterns emerge. “People will still heavily compete for highest quality land,” says Hensley. “But they are not going to go out as far on a limb for B-quality and C-quality farms.” This market shift may lead to fewer public auctions, and a few more private treaty sales and other sale methods.

Push-Pull in play in 2023

What is a Push-Pull Market? It is the battle of factors which determine the direction of the market. Some of these factors still point towards and will push land prices higher, while others offset more negatively and pull land prices lower. The factors still “pushing” toward higher land prices, will be driven primarily by this past year’s high yields and still strong commodity prices, says Hensley. Also supportive to land values: Political instability in other parts of the world (e.g., Russia/ Ukraine), thereby making U.S. ag products attractive, along with general demand growth and food inflation.

We may also see a decline in the amount of farmland coming up for sale, which would continue to support land prices. “Over the past two years, as farm values streaked higher, there was a strong incentive for owners to sell land. Not everyone who looked at a sale pulled the trigger. However, many landowners who were considering a farm sale, did sell, especially those who had waited for market conditions to improve from 2015 through 2020. “Given the large volume of land sold the past couple years, I anticipate sales volume for farmland will start to come down in 2023,” says Hensley.

On the flip-side of the coin, the factors “pulling” land values lower, include higher interest rates, much higher 2023-crop input costs, and a tighter operating margin environment in 2023. Depending on the input product, costs have risen anywhere from 30% to 100% higher compared to inputs for the 2022 crop, reports Hensley. “This leads to tighter projected profit margins. I expect the breakeven price for most corn producers will be $5 per bushel or more for the 2023 crop,” he notes. “And it wasn’t long ago that farmers dreamed about $5 corn.”

When will we start to see impact of higher interest rates on farmland values? Farm mortgage rates have now climbed into the 7% to 8% range. So, the math has changed for those land buyers borrowing money. However, up to this point, many land sales have been for cash, or limited borrowing. “The significantly higher commodity prices, especially for corn, soybeans, and cattle, have resulted in a significant increase in farm income and cash on hand,” notes Cornell University ag economist Wendong Zhang, formerly with Iowa State University (and continuing researcher with the Iowa State Land Value survey). “And because of supply chain issues, farmers who would have wanted to buy another tractor or combine but had a really hard time finding a new one to buy, invested in farmland because land is what they know,” says Professor Zhang.

The ag economist also reports it takes time for higher interest rates to be reflected in the farmland market. “It takes about a 12-18 month lag from when the Federal Reserve makes policy movements,” Zhang says.

Higher interest rates also make alternative investments such as bonds more attractive to investors, potentially reducing investor demand for farmland investments.

Another way to look at higher interest rates: One potential farm buyer told his banker, “I can get 3% to 4% on a Certificate of Deposit, or I can get a 3% return in cash rent on farmland [bought with cash]. I think I’ll to buy a CD now and wait for land values to cool down a little before I buy land.” So, while we remain in a strong land market, there are differences compared to a year ago. Some factors are still pushing values up, but other factors are pulling back, thereby creating more of a sideways market.

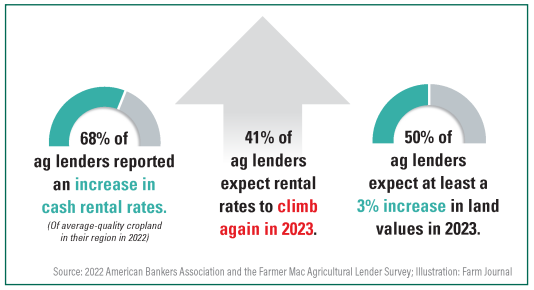

Cash rents broadly higher

“Cash rents for the 2023 crop have reset anywhere from 5% to 15% higher, depending on where you’re starting from,” says Hensley. And that’s in areas that saw good yields in 2022. There is more pressure on land values and rents in some areas that desperately need moisture. Drought conditions in parts of the western Corn Belt reduced yields in 2022. “Nebraska reported yields of 20 to 50 bushels per acre for soybeans and 100 to 220 bushels per acre for corn. The above-200 bu. per acre corn was on irrigated farms, and even at those levels, it was still a bit of a disappointment,” Hensley explains.

Other pockets also experienced drought, but were more localized than what we saw across large areas of Nebraska and western Iowa. “Yields around Champaign, Illinois, for example, came in with 220- 230 bushel corn, but they are accustomed to raising 270-280 bu. per acre for corn,” reports Hensley, “so you can imagine their disappointment in missing out on their average yields in a year when commodity prices are so strong.”

Other regions of the Corn Belt were also dry, but received some timely rains so yields commonly came in at or above average, which created a very strong profit year.

Value of an expert real estate agent

With high input expenses burning through cash, and borrowed money becoming more expensive, land buyers will be looking for ways to limit risk. “There won’t be as much competition in 2023 for lower-quality farms,” predicts Hensley. “They probably ought not to be sold at auction.”

As the market tightens up, “success at selling farms will come down to the quality and skill of the firm and real estate agents selling the farm,” says Hensley. “The past two years were such a go-go time, everything sold. Now as the land marketplace shifts, real estate selling skills and local expertise will become even more important to help determine which sale method is best, knowing how to appeal to potential buyers, understanding the area, and determining the best timing for a sale. These factors will become more and more important to achieve a successful land sale in 2023,” concludes Hensley.