Grain Markets - Winter 2024

__primary.png?v=1731443353)

As we move through the 2024 harvest season, both the corn and soybean markets are presenting opportunities and challenges that can affect the financial outlook for farmland owners. Understanding these trends is crucial for making informed decisions about your farmland assets, lease agreements, and future land value.

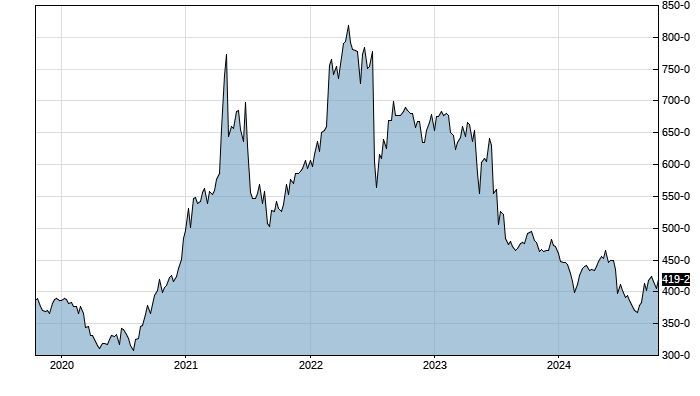

Corn Market Overview

This year’s corn harvest is expected to produce record yields, with USDA estimating the average yield at an impressive 183.8 bushels per acre. Despite strong demand from ethanol, exports, and feed use, corn prices remain under pressure from large on-farm stocks and abundant supply. The USDA projects the 2024- 25 crop at 15.2 billion bushels, slightly lower than last year, but still sufficient to meet demand, with ending stocks just under 2 billion bushels.

For most landowners, this means that rental income from farmland will be steady to lower in 2025 and any further pressure on commodity prices could impact future rental negotiations. With December 2024 corn futures currently trading around $4 per bushel, some flexibility in lease structures—such as variable rent or crop-share agreements—may help capture value in fluctuating market conditions.

December 2024 Corn Futures

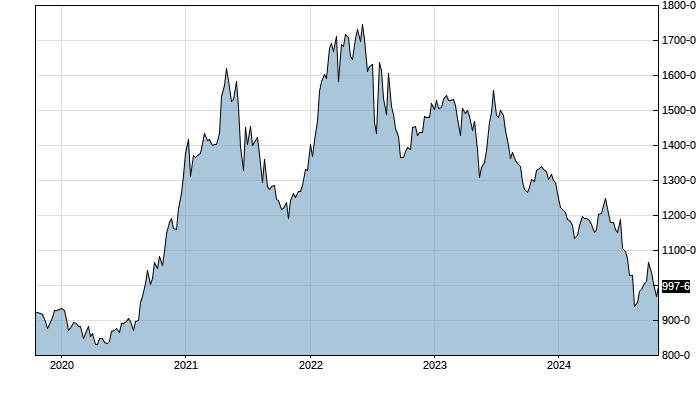

Soybean Market Trends

Soybeans are facing similar challenges. With seemingly ever increasing production out of Brazil and exports to China waning, prices have faced strong headwinds this year. While soybean crush demand continues to increase, it has not been enough to offset the large increase in supply seen on the world market. The USDA projects the 2024-25 soybean crop at 4.58 billion bushels, driven by an average yield of 53.1 bushels per acre. Current November 2024 futures are trading around $10 per bushel.

The potential for lower soybean prices can impact cash rent negotiations, particularly if tenants face tighter margins. However, if we see a resurgence of strong export demand—especially from China— it could provide a buffer, potentially supporting future price. If the Brazilian growing season runs into issues, that could be the spark needed for China to step in and make additional purchases from the U.S.

November 2024 Soybean Futures

What Should Landowners Watch?

As a farmland owner, it’s essential to stay attuned to several key market drivers:

- Global Trade and Demand: Corn and soybean exports, particularly to countries like Mexico and China, are significant to long-term price trends. Ongoing trade policies and international demand will shape rental income potential.

- Weather Patterns in South America: With Brazil and Argentina becoming increasingly important players in the global grain market, the growing conditions in those regions will impact U.S. grain prices.

- U.S. Ethanol and Biodiesel Production: Continued demand for corn and soybeans for biofuel production could help counter-act some of the downward pressure on prices, influencing future rental rates and property values.

As we move forward, farm owners should consider reviewing their current lease agreements and discussing options with farm managers to ensure they’re accomplishing your ownership goals. Flexible lease structures that account for commodity market fluctuations can help secure better returns over time. Additionally, keeping an eye on the future of U.S. agriculture policy, particularly as it relates to renewable energy and export demand, will be crucial in navigating the evolving landscape.