Farmland Values Still Strong, But Upside Limited

Article from Winter 2024 Hertz Outlook Newsletter

After several years of climbing to new heights, farmland values appear to be leveling off, notes Doug Hensley, president of Hertz Real Estate Services. That’s not to say top quality farms aren’t still attracting strong prices. In late October, one Marshall County, Iowa auction Hertz sold brought $21,300 per acre for a 77-acre farm with a 94.4 CSR2 soil rating (very high quality) next to a hard-surfaced road; and in late December Hertz sold another 176 acres in Piatt County, Illinois that brought $21,200 per acre at auction. “But the market is not currently as deep for lesser quality farms as it was in late 2022,” Hensley explains.

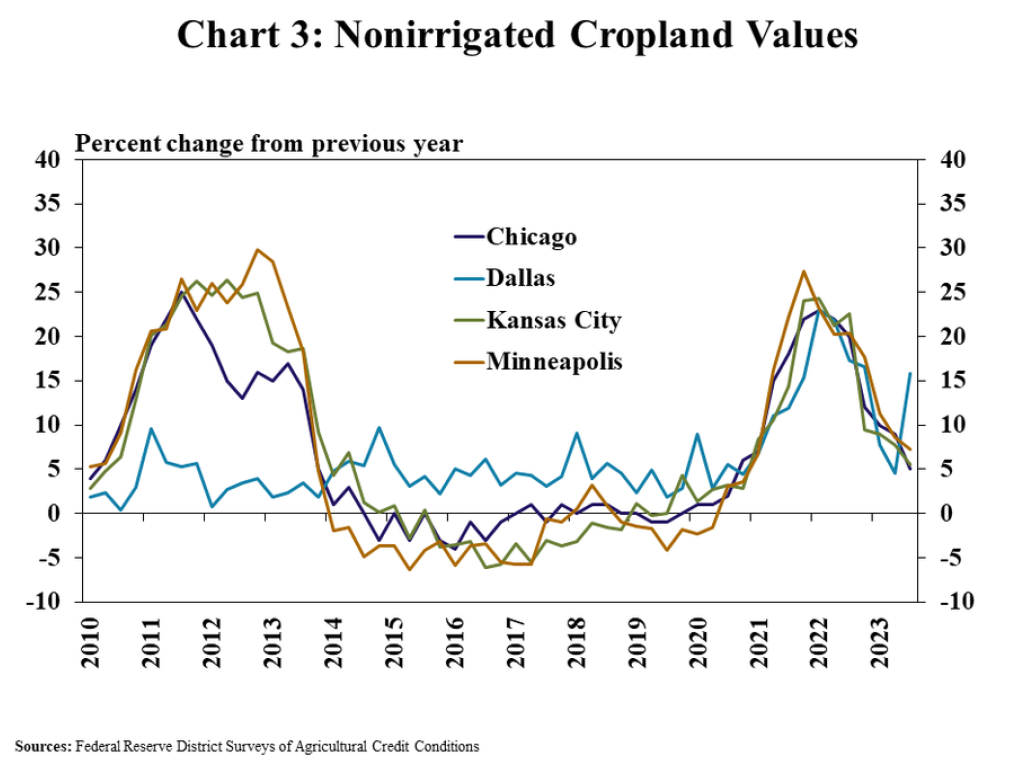

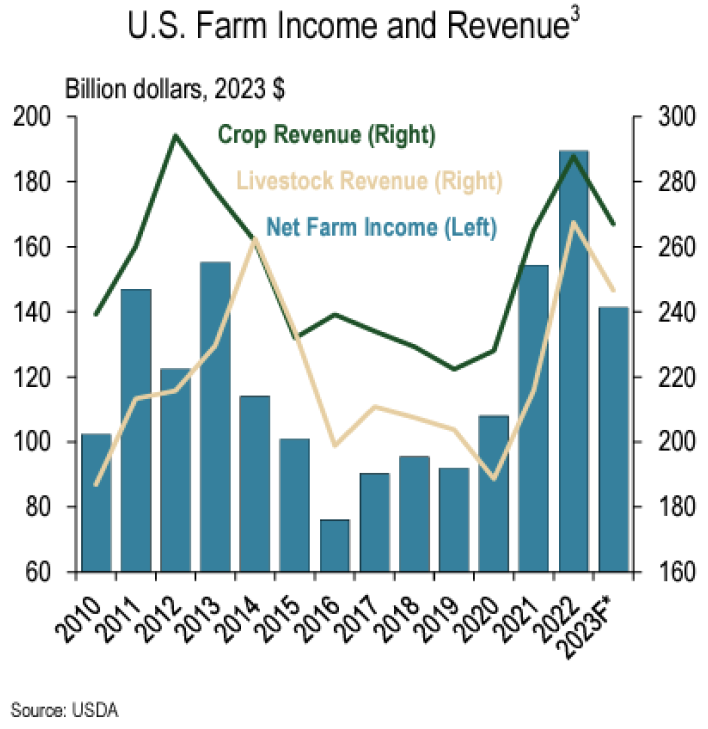

The main pressure point on land values is the drop in commodity prices. Although higher interest rates have also been negative, their impact has not yet been as significant.

Corn prices have skidded 27%, comparing USDA’s report of last year’s crop’s season-average farm price of $6.70 per bushel to its forecast of only $4.85 per bushel season-average price for this year’s crop in the 2023-24 marketing year.

“We’ve just experienced two to three years of record farm profits, but 2023 profit margins tightened,” Hensley says. And with a tempered outlook, that has put the brakes on setting new highs for farmland.

Commodity price worries

“Looking into early 2024, much will depend on the South American crop,” explains Hensley. “We’re now getting into the middle of their growing season and if it looks like they’ll have a bumper crop, that will pressure our commodity prices, and subsequently will be a bit of a wet blanket on land values.” Conversely, if the South American crop experiences weather problems, that could push corn and soybean prices higher and pump up U.S. ag exports, which had collapsed last year. “We’ll be watching the development of the crop in South America closely in the first quarter of 2024,” adds Hensley.

Higher interest rates have impact... on borrowers and savers

Fortunately, most farmland buyers have not been borrowing heavily to finance land purchases because of recent record farm profits. “Cash has been powering most land purchases which has kept land values stable, overall,” Hensley reports. And the predominant buyers of farmland are farmers.

But the draw of investor dollars to farmland, which can often help support land values is diminishing a bit, says Hensley. Pure-play investors can get a 5% return on their money with virtually no risk at any local bank. “So, farmland is not the most competitive asset class at these interest rate levels,” says Hensley. “That has taken away what I call the ‘pureplay investor’. And investment alternatives to farmland are more positive now than they have been in the past couple years.” Since developers tend to use more borrowed money for their purchases, current high interest rates curtail their purchasing power. Also, high interest rates slow down customers looking to buy a new house or rent commercial space.

Another type of investor Hensley expects to be more affected by higher interest rates is the 1031-exchange buyer. In a 1031-exchange, when a developer buys farmland to convert into commercial or residential property, the land seller can find other farmland or investment property to buy (within a set period of time) and in the “exchange,” defer capital gains taxes on any appreciation he had in the original property. The IRS code allowing this tax deferment is Section 1031 – thereby the name ‘1031 tax-deferred exchange’.

“We’re just starting to see a slow-down in development projects,” says Hensley. “Lenders I’ve talked with in growing markets are not as busy as they were a year ago, so we’re beginning to see downstream 1031 activity also slow, and this will eventually have an impact on the farmland market; not a huge one, but 1031 buyers do matter because they have a tendency to be very aggressive and competitive, when they have reinvestment money to place.”

With fewer outside investors, the farm economy becomes even more of the central factor in land values, and that makes the land market more sensitive to commodity prices.

Fewer land sales and lower input costs support land prices

After a wild two-year stretch from mid 2021 to mid- 2023, Hensley expects land sales volumes to transition back to something more normal. “We saw more ‘elective sales’ the past couple years, as farmland owners wanted to take advantage of high land values and some were worried about potential tax law changes. Now, we’re getting back to more normal volume,” Hensley reports. Less property for sale supports stable farmland prices.

Also sustaining steady land values are lower input costs, compared to last year. This is predominantly from lower fertilizer costs. The University of Illinois forecasts an average breakeven price for corn in Illinois around $5.00 per bushel and for soybeans, $12 per bushel across all regions of Illinois.

Cash rents stable

With the uncertainty of commodity markets and lower fertilizer costs, cash rents are expected to be stable to slightly higher in areas that had good yields in 2023. However, where there was a drought this past year, such as northeast Iowa, southeast Minnesota and in northeast Nebraska and western Iowa, they had weaker yields and we may see a little pressure on cash rents there, Hensley explains.

Hensley views the land market as steady ahead, with fewer land sales, no heavy pressure on values as we head into the new crop year, and generally limited upside -- barring major weather problems in South America or the Midwest.