Farmland Value Update - Winter 2024

__primary.png?v=1731445023)

“The market is very smart.” This is a true-ism that I commonly reference with our team. Sometimes I share it when someone is surprised by a land sale that exceeded our price expectations, and other times, it is my response when someone is struggling to sell a farm in a more difficult market.

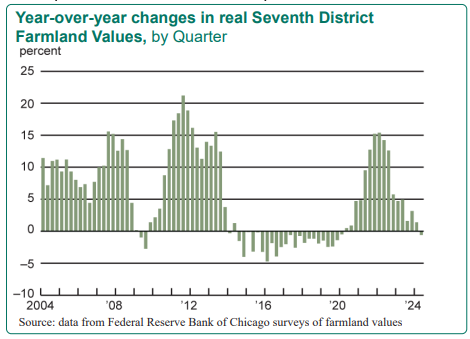

Right now, the market is showing its smarts, as conditions over the past year have changed. A return to a much lower commodity price environment, in conjunction with higher interest rates since late 2022, have crimped on-farm profit potential and enthusiasm in the pursuit of land acquisitions. And looking ahead into the 2025 crop year, we see another increase in input prices, which is further diminishing marketplace excitement.

However, an important caveat to understand is that the countryside is not broadly or overtly weak. Yes, there are some shaky, highly leveraged individual operations. However, for most, finances are generally solid, and there is a depth of wealth and profits from recent years that will buffet the economic waves. That said, I’ve learned that most farmers understand the nature of agriculture’s economic cycles, and in the current environment, they are even more carefully weighing new land purchases against the protection of their working capital. In addition, yield-seeking investors have re-discovered competitive investment options outside of the farmland market. Thus, the land market exuberance of 2021 through much of 2023, has subsided, and people are less aggressively pursuing acquisitions. These market realities have started to show up in several state-level land value reports and surveys.

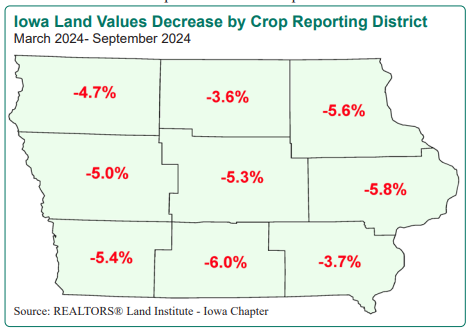

Iowa Land Weaker in 2024

The Iowa Chapter of the REALTORS Land Institute reported a 5.0% statewide average land value decrease for the March 2024 to September 2024 time-period. This report followed the September 2023 to March 2024 time period, which showed a 3.1% statewide decrease, giving Iowa farmland a 12-month total decrease of around 8% on tillable acres. In discussion with respondents, much of the decrease in land values can be directly attributed to lower commodity prices.

Illinois Land Showing Mid-Year Softness

According to the Mid-Year Survey conducted by the Illinois Society of Professional Farm Managers and Rural Appraisers, Illinois land values have also declined. Excellent and good-quality farmland experienced a 5% drop, while average and fair-quality farmland saw steeper declines of 8% and 10%. Looking ahead, 89% of survey respondents anticipate further price decreases, while 11% expect farmland prices to remain stable.

Nebraska Cropland Still Up, But Slowing

The early 2024 land value survey published by the University of Nebraska-Lincoln showed a 5% year-over-year increase in land across the State. However, looking deeper into the report and comparing it against recent years, shows a flattening in cropland values, while grazing and hayland continues to appreciate comparatively more rapidly due to the strength in the cattle market.

Minnesota Land Higher, But Caution Warranted

According to a Q2 report from the Minneapolis Fed, non-irrigated farmland values in the Ninth District rose 3% year-over-year in early 2024, despite well-known challenges in the agricultural sector. The ‘24 growing season was somewhat difficult across much of southern Minnesota because of flooding and generally too much rain, and farm income pressure is expected because of significantly lower commodity prices. Lenders are suggesting caution.

Conclusion

The market is very smart. As we conclude 2024, the Midwestern land market has transitioned into a new stage of the economic cycle. The prior exuberance in farmland from 2021 through most of 2023 has subsided, and we now face a more historically typical low commodity price environment, with interest rates that have also increased to more common long-term levels. In similar past cycles, farmers and farmland owners have endured tougher economic conditions through strong decision making, adept working capital management, and measured risk-taking with an eye on growth. I’m confident the same will happen this time around.