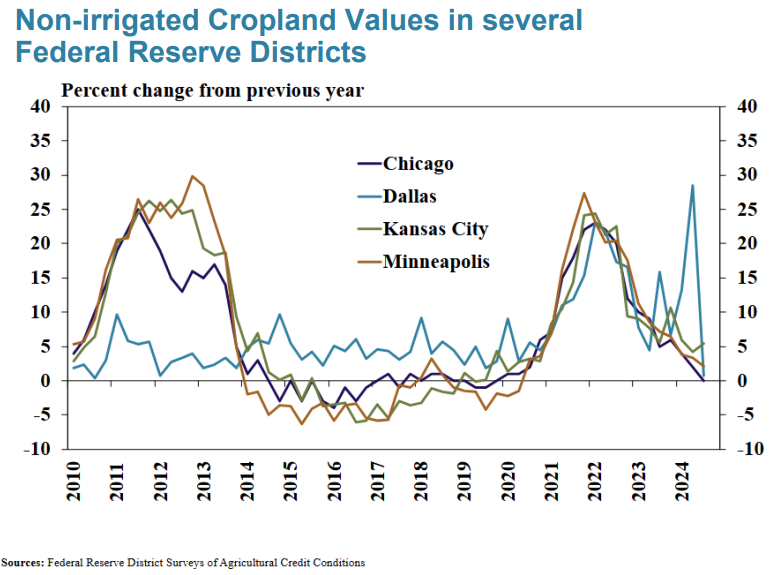

Cyclical Land Values Head Into Flat Territory

__primary.png?v=1737471670)

For the first time since 2019, farmland valuation in the Chicago 7th Federal Reserve district remained unchanged from the previous year. The Chicago district includes Iowa, the northern half of Illinois, northern Indiana and southern Wisconsin and Michigan.

After four years of strong growth, cropland values across all regions are cycling into a flat-to-negative pattern. Further west, the Kansas City Federal Reserve district’s non-irrigated cropland values were still up 5% on the year in the third quarter of 2024, powered largely by a strong livestock market. However, lenders in the region which includes Nebraska, Kansas, Oklahoma, Colorado, Wyoming and parts of Missouri and New Mexico, reported sharply lower crop farm income and slightly slower loan repayments. A profitable cattle market, in particular, has helped some producers in this region. But as one lender reported, “Current grain prices are putting continued pressure on margins and most farmers have recognized the lack of profitability and have pulled back spending.”